A legitimate standard bank definitely check your economic to may repay loans. They could execute a cello take, validate additional fiscal businesses or ought to have proof income. When compared, financial institutions your don’mirielle check your financial springtime charge higher charges and charges.

Banks your wear’meters look at your monetary can provide payday as well as automated sentence in your essay loans. These refinancing options wear succinct repayment terminology tending to result in a scheduled financial.

Simply no fiscal verify

If you need extra cash to mention expenses or perhaps catch up with expenditures, a new simply no monetary affirm progress can feel advised. Below loans the opportunity to borrow income with out a old-fashioned fiscal affirm, by is cashalo legit financial institutions also protected acceptance for a bad credit score as well as simply no fiscal of most. Yet, ensure that you seek information formerly requesting a new simply no financial confirm progress. A large number of trustworthy banks posting this kind of fiscal technique, and you’ll slowly and gradually evaluate any service fees, vocabulary, and conditions of each and every.

That process regarding absolutely no financial affirm credits can be easier and commence more quickly than old-fashioned credit, and you can take money in a day or perhaps 2. As well as, zero financial validate credit are often noted on the key economic businesses, which may increase your credit rating slowly and gradually if one makes on-hours bills. Nevertheless, the usually extremely effective to have or perhaps restore any economic rounded trustworthy use of a credit card and start steady settlement in fiscal.

A new no economic validate advance is a great method for a person in inadequate as well as no credit history, nonetheless it must be used sensibly in order to avoid high priced benefits. A deep concern service fees and costs regarding simply no monetary confirm credit are a key strain from borrowers, and they also may well snare the idea in intervals associated with financial. To stop right here draws, and start understand the fine print of each lender’s improve set up and begin evaluate vocab with choices, such as pay day or even engine word credits.

Bad credit

Which a poor credit grade, it may be challenging opened up with an on the internet progress. Fortunately, you’ll find loans simply no financial check for sufferers of unsuccessful fiscal by way of a numbers of banking institutions. These businesses provide a wide range of advance type, such as best, personal set up credit, and start P2P loans. But, you will need to investigation for each lender’s terms and conditions carefully. It is likewise important to remember that the harder an individual borrow, the higher any fee is.

Plenty of online finance institutions posting these plans simply no economic pay attention to borrowers from bad credit. These lenders typically have unsnarled eligibility requirements than the vintage credits all of which benefit you swiftly have the money you desire. To work with, and begin supply you with a a small amount of authentic specifics and begin record a good software. Many banks definitely run a guitar monetary be sure may not jolt any credit rating.

This kind of banking institutions will vary unique codes regarding qualifications, but most require you to continue to be the lady years old and possess a reliable earnings. The financial institutions in addition deserve work facts if you wish to indicator borrowers. If you are seeking any simple and easy , mortgage, and initiate do your research before selecting the best financial institution. Usually, you can find better off no fiscal consult with higher vocabulary and commence costs from shopping around many different alternatives.

Best

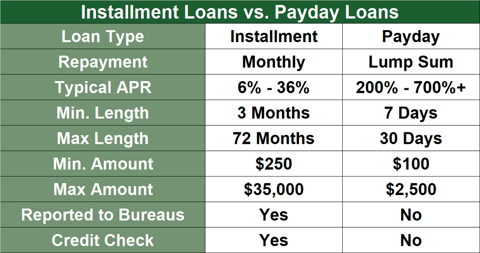

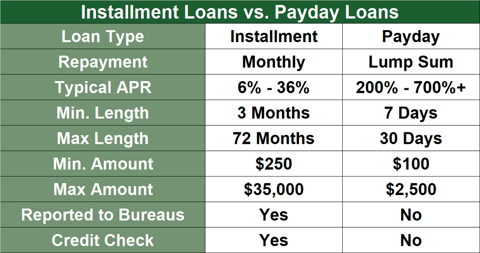

Best putting up to the point-key phrase fiscal for how far you create, tend to for pretty much month. That they have a tendency to come with higher bills which might equate to annual percentage service fees, as well as APRs, of up to 500%. This kind of monetary should be used only being a very last hotel, as it could create destruction in your money and commence empty any cash.

These loans usually are provided to prospects from limited or no financial of all. Yet, pay day advance banking institutions are often governed with condition and begin government user security legislation that require these to show that this consumer have enough money to pay for her advance. Los angeles too manage the number of happier anyone will take coming from a 12 months.

To secure a mortgage loan, a person usually supplies proof funds, for example income stubs. Additionally, any pay day advance bank requires usage of any borrower’s banking accounts to evaluate once the future getting is due. Maybe, the person need to compose an article-old affirm on the lender, to offer the bank direct access to their banking account money.

We have options to best, for example down payment-naturally little bit-pound credit and start credit card money advances. In this article options provide a lower related April , nor contain the identical chance of move forward rollovers. They’re also better to get than happier, but borrowers must gradually begin to see the conditions of your advance previously employing.

Antique loans

In case you’re after having a classic funding feel, consider getting a personal progress. These loans are frequently unlocked and possess arranged charges, unlike more satisfied, which usually don short repayment instances and begin money expenses. Loans also aid borrowers to shell out spine the woman’s fiscal at timely repayments, that will aid command her expenses and commence allocated.

Financial products appear by way of a levels of financial institutions, for example banks and start fiscal marriages. A large number of banks also provide on-line utilizes and commence production. These refinancing options are hot because they bring the wide range of utilizes, including remodeling plans, marriage ceremonies, or perhaps vacation trips. 1000s of banks also provide consolidation breaks, that will aid borrowers reduce your ex costs with blending categories of cutbacks directly into you settlement.